An Evolutionary Game-Theoretic Reformulation of the Lux--Marchesi Model of Financial Markets

Image credit:

Image credit:Abstract

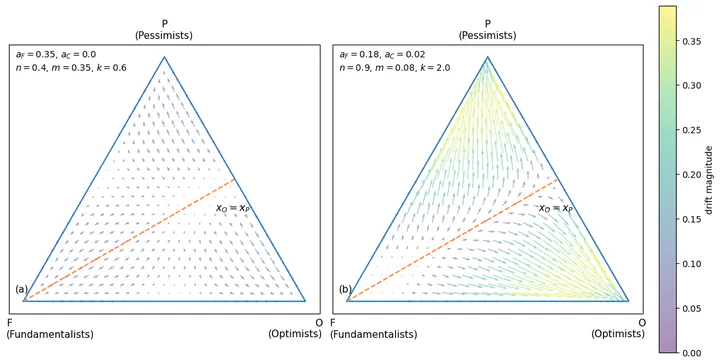

This paper reformulates the Lux-Marchesi (LM) asset-pricing model within an evolutionary game framework to examine how payoff-driven strategy selection shapes market dynamics. We consider three trading types-fundamentalists, optimistic chartists, and pessimistic chartists-whose population shares evolve endogenously through a discrete-time logit-replicator dynamic with mutation. As in LM, prices adjust in response to aggregate excess demand, constructed as a composition-weighted sum of strategy demands, while strategy payoffs are computed from realized trading profits averaged over a finite evaluation window. The resulting coupled price-selection system captures a competition between stabilizing mean-reverting forces (fundamental trading) and destabilizing directional forces (chartist trading), generating distinct market regimes. To provide analytical insight, we study a reduced two-strategy specification and characterize the stability of boundary regimes, as well as the conditions for tipping when the chartist share crosses an interior threshold. Numerical experiments across baseline, stable, bistable, and switching parameterizations demonstrate that endogenous reallocation of trader shares can produce bubbles and crashes, heavy-tailed return distributions, and volatility clustering. Importantly, these stylized facts arise from persistence and switching in the composition dynamics, rather than from imposing non-Gaussian exogenous shocks.

Type

Publication

SSRN