Development of ESG Factors for Enhancing Factor Model in the Thai Stock Market

Feb 13, 2024· ,,,,,·

0 min read

,,,,,·

0 min read

Pasin Marupanthorn

Teerasit Termsaithong

Nuthdanai Wangpratham

Jutha Koryanyong

Chanon Chanpiwat

Carat Pathomsathit

Image credit:

Image credit:Abstract

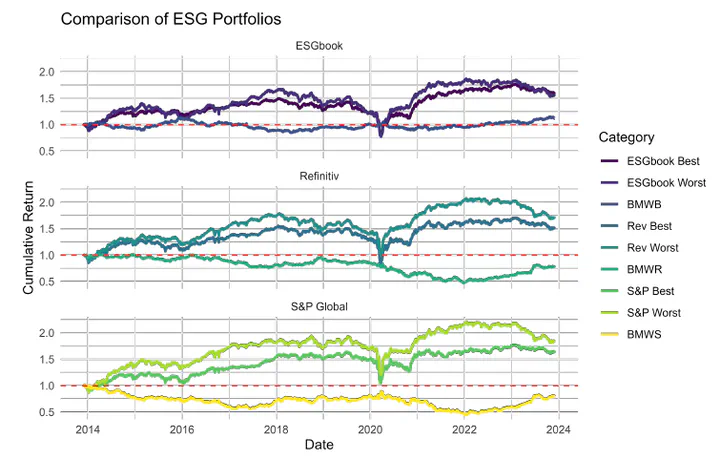

This study investigates the incorporation of Environmental, Social, and Governance (ESG) factors into Thai stock market analysis, emphasizing the Thailand Sustainability Investment (THSI) platform. Central to this is the integration of a’best minus worst’derived ESG factor into the Fama-French three-factor model, serving as a proxy for ESG impact on stock returns. The research employs a homogeneity covariance matrix test to establish the ESG Best Minus Worst (BMW) factor’s distinctiveness from traditional market factors. Results show the ESG BMW factor’s unique covariance structure, enhancing existing models and highlighting variability due to different rating agency methodologies, thus impacting investment decisions. The study finds the modified Fama-French model with the ESG BMW factor more effective than q-factor models in explaining THSI-listed stock returns, demonstrating its relevance in Thai market analysis.

Type

Publication

SSRN, 2024